The logistics industry is buzzing about tariffs and geopolitics—and for good reason. With uncertainty swirling around trade policies, especially with China, many shippers are stuck in reactive mode. Imports have slowed, inventories are in flux, and the near-term focus is all about navigating the current disruption.

But history has shown that the real challenge isn’t just surviving volatility—it’s planning for what comes after. While headlines focus on tariffs today, the companies that will come out ahead are already thinking about the recovery. What happens when demand surges again? When capacity tightens? When your competitors are scrambling for space and service?

Now is always the time to prepare—not just for disruption, but for the rebound.

Temporary Disruption, Lasting Consequences

Even though the full impact of current tariffs is still unfolding, early signs point to slowed international imports, cautious buying behavior, and increasing concerns over empty shelves. This pause may not feel as dramatic as the early days of the COVID-19 pandemic—but it’s setting the stage for a meaningful shift in demand and supply chain strategy.

Retailers and manufacturers are already delaying purchase orders. Some are struggling to get product from overseas, and others are choosing not to buy at all in the face of uncertainty. But this won’t last forever. Sooner or later, pent-up demand will re-enter the market. When it does, the ripple effects could extend across every transportation mode—from drayage to LTL to full truckload.

The question isn’t if there will be a demand surge. It’s when—and whether your supply chain will be ready when it hits.

Lessons from the Past (But This Isn’t 2020)

To be clear, this post-tariff environment won’t mirror the chaos of 2020. During the pandemic, stimulus dollars flooded the economy while consumers redirected discretionary spending toward home goods, gym equipment, and office furniture. Supply chains were overwhelmed from port to porch, and capacity evaporated across all modes seemingly overnight.

That level of hypergrowth was fueled by one-time factors unlikely to repeat. Today’s consumers are back to dining out and taking vacations. There’s no stimulus check surge coming. And few companies are stocking up based on predictions of a “new normal.”

Still, one lesson remains critically relevant: disruptions create delayed demand, and when the market rebounds, it typically rebounds fast. In 2020, it was containers waiting weeks at ports and freight stranded for lack of capacity. In the coming months, the trigger may be different—but the consequences could be strikingly similar.

If you wait for the market to tighten before you act, you’re already behind.

Strategic Moves Shippers Should Be Making Now

The companies that emerge strongest from this market turbulence won’t be the ones that simply weather the storm—they’ll be the ones who used the pause to reposition. Now is the moment for smart planning, not reactive scrambling.

Here are three strategic actions shippers should be taking now:

1.) Pull Forward Inventory Where Possible

If you haven’t already moved to front-load inventory ahead of tariff increases, it’s not too late. Even limited forward positioning can make a critical difference when product availability starts to lag. Consider what you’ll need in Q3 and Q4—and secure it while capacity remains manageable.

2.) Diversify Sourcing Beyond China

While China remains a dominant player in global trade, escalating tariffs make it a risk-heavy option in the near term. Countries like Vietnam, India, and Mexico may offer more stable alternatives—especially for goods that can be relocated with minimal disruption. Look for sourcing strategies that reduce your tariff exposure while maintaining supply reliability.

3.) Align With Multi-Modal, Financially Strong Partners

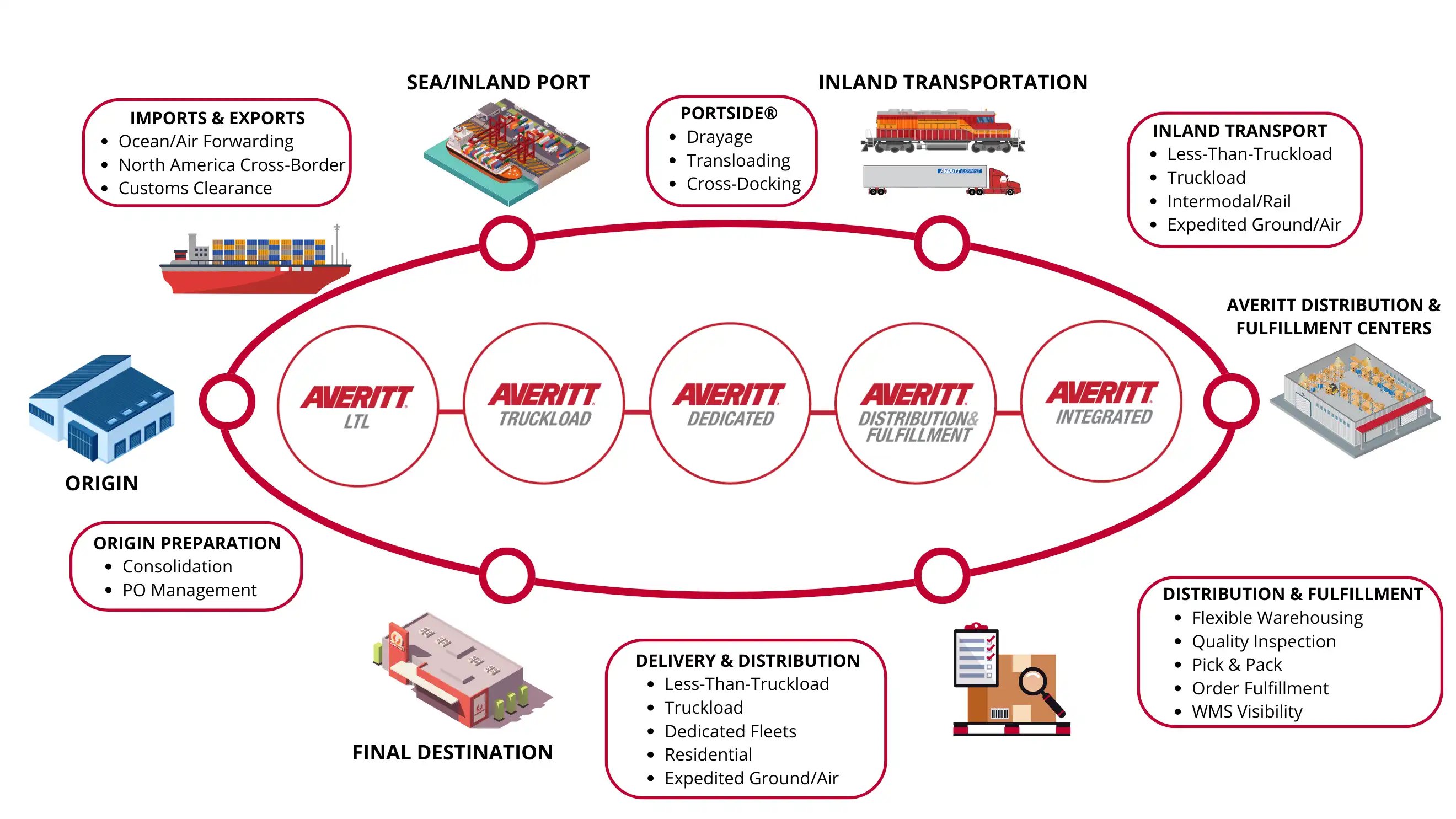

Now more than ever, who you ship with matters. The freight market has been in a prolonged recession, and smaller providers—especially those reliant on the spot market—may not survive another prolonged downturn. Partnering with financially sound logistics companies that offer a wide range of services—drayage, transloading, LTL, truckload, dedicated fleet, warehousing—can provide insulation when demand rebounds and capacity tightens. Flexibility across modes gives you room to pivot when the unexpected happens.

Why Your Transportation Partner’s Stability Matters

In uncertain markets, it's tempting to chase the lowest rate. But as history shows, low-cost providers are often the first to falter when the market tightens.

Some smaller carriers are already showing signs of strain. In a prolonged freight recession followed by declining volumes from tariff-related disruptions, it’s likely that we’ll see further contraction. For shippers relying heavily on the spot market or single-mode providers, that could mean delayed freight, broken commitments, or even freight left stranded.

That's why carrier stability isn't just a finance department concern—it’s a supply chain imperative.

Shippers should take a hard look at the financial health, service breadth, and operational reliability of their partners. Providers that offer multi-modal flexibility and end-to-end solutions—who can move your containers, handle your warehousing, and deliver to your end customers—are better positioned to help you adapt in a crunch.

And perhaps most importantly, long-term relationships matter. In tight markets, providers prioritize customers they know and trust. A last-minute call for help isn’t likely to get answered when capacity is scarce—but strategic partners will always get a seat at the table.

The Cost of Inaction

There’s a hidden risk in waiting for clarity. While many shippers are in “let’s wait and see” mode, capacity is slowly being absorbed, freight networks are tightening, and carriers are taking note of which customers are proactive—and which are last-minute emergencies.

When the rebound hits—and it will—those without established plans and partnerships will find themselves scrambling. Providers will be stretched. Equipment and labor will be limited. And calls to unknown carriers will be met with silence or sky-high rates—if answered at all.

If you haven’t invested in strategic relationships, secured access to flexible services, or diversified sourcing and inventory, the cost won’t just be higher freight bills—it could be lost sales, missed deadlines, and damaged brand trust.

In a post-tariff surge—or any macroeconomic disruption—agility isn’t optional. It’s the price of staying competitive.

Planning Beyond the Headlines

Tariffs may dominate today’s headlines, but tomorrow’s challenges—and opportunities—will look different. The companies that succeed won’t be the ones that merely react to the noise. They’ll be the ones that anticipate the rebound, prepare their networks, and strengthen their supply chain from end to end.

The takeaway is simple: don’t wait for chaos to arrive before you act. Use every moment of uncertainty to evaluate or execute bold, strategic moves—whether it’s diversifying sourcing, building inventory buffers, or aligning with stable, full-service transportation partners.

Recovery isn’t a question of if, but when. And when it comes, capacity will be stretched, competition will be fierce, and only those who planned ahead will have the flexibility to move fast.

It’s not about bracing for impact. It’s about preparing for momentum.

Why Strategic Shippers Choose Averitt

In times of disruption and in times of growth, one constant remains: the need for dependable, flexible logistics partners. At Averitt, we’ve built our business around long-term relationships—not one-off transactions. As a privately held, debt-free company with more than 50 years of experience, we’re financially stable and built to scale with our customers.

Our integrated services span every link in the supply chain—from port drayage and transloading to warehousing, LTL, full truckload, and final mile delivery. That means when the unexpected hits, our customers don’t scramble to find capacity—they rely on a team that already knows their business.

With a single point of contact and 24/7 U.S.-based support, Averitt helps shippers adapt faster, execute smarter, and prepare for what’s next—no matter what the market throws their way.

If you’re planning for the rebound, we’re ready to help you lead it.

Watch the short video below to learn how our asset-based integrated solutions help Spectra Gutter at every turn in its supply chain.

My name is Alan Hensley. I work for Spectra Gutter Systems and based in Atlanta, Georgia. We're the largest manufacturer of what they call gutter rainware. We manufacture from the raw material that comes in, and then we have our branches around the country, and we retail it out from there. Our manufacturing has grown, and we are now into importing. And so that's allowing us to use Averitt for importing. They also have the fulfillment centers where we can store stuff or have it transloaded. Alan contacted me and wanted to know if we could be of assistance. We were able to create a solution where Averitt will dray the containers when they come in to either our distribution and fulfillment centers to transload or directly to Spectrum gutters. Back in 2017, we started out using Averitt to do some of our truckload logistics to our different branches. And over time, we integrated the LTL system as well into a 3PL system we already have. They're able to help us get our new product we're having made overseas into the port and then to get it to our facility in Atlanta. I don't have to worry about having different people to pick it up at the port and different people to get it to us. It's just one place, one stop, and they handle it from there. Our technology will give them complete visibility of their product from the time that it ships to the time it arrives to their door. You know, we want it looking pristine when it gets there. The box is not crumpled and torn up. That says a lot as well. So they transport that when it leaves our facility in that condition and it gets to the customer in that condition. Our goals for the future for Spector Gutter Systems is to be in all the states, across the country. We have a five-year goal to have be a billion dollar a year company, and we're gonna need lots of transportation. They're gonna need a great partnership like we have, with Averitt. This allows us not to have to slow down, but we can keep it going to where we have facilities to store it in in the fulfillment centers that are out near our branches. And then we can propagate it out from there and it goes across the country. So they'll be a big part of helping us to grow. I think we can help them put their product in different locations to beta test on areas they wanna grow in without making a full commitment of staff and resources. That is a great enhancement and a great partnership because as we grow, we don't have to necessarily put on drivers and trucks right away to be able to do that. We can use their system and their dedicated drivers to be able to do that. There's that Power of One to help us to grow. Well, the reason why we're calling it Power of One, is Spectra Gutter Systems are using our truckload, our LTL, and are integrated to provide solutions for them. We are also expanding into distribution and fulfillment as well as possibilities of dedicated that would help them grow closer to that one billion dollar goal. It's the power of one company being able to meet all of my logistic needs. The deal about Power of One - I always like to come back to the relationship. Averitt believes in taking care of the relationship and and the person, not just the business. Whatever my problem is, they are solution to help us to solve it. And they will go to whatever extreme it needs to be to make it. Whether it's making room in a warehouse, it doesn't matter. I want a partner that's like that and Averitt fulfills that for us.

Ready to strengthen your supply chain for what’s next? Let’s talk strategy.

.png?width=542&height=179&name=PNG-Averitt%2055%20Years%20RED%20ODFIP%20(1).png)